💵 💴 💶Bitcoin Starts the Week with a Record💴 💶

As widely known, Donald Trump is set to officially assume the presidency of the United States today. Nicknamed “the world’s first crypto president” for his support of Bitcoin and cryptocurrencies, Trump’s arrival at the White House may have triggered the recent rise in Bitcoin. The crypto world and the U.S. public are expecting Trump to take crypto-friendly actions through executive orders. These orders often come in the early days of a presidency, which might explain the anticipation among Bitcoin and crypto investors.

GLOBAL MARKETS

While the dollar maintained its value, cautious trading was observed in Asia as investors awaited the policy announcements from U.S. President-elect Donald Trump upon his inauguration and the expected interest rate decision from the Bank of Japan (BOJ) later this week. Trump, who will assume office at 8:00 PM (TSI), is expected to make several decisions immediately. Showing himself to be a highly unpredictable leader, Trump introduced a digital currency on Friday with a total market capitalization of over $15 billion, briefly trading above $70.

Increased Bitcoin Inflows from U.S. Investors Ahead of Trump’s InaugurationLeading cryptocurrency Bitcoin experienced notable inflows from U.S.-based investors ahead of Donald Trump’s inauguration on Monday. This trend suggests that American investors have been accumulating BTC, reflecting their growing confidence in an upward price movement post-Trump’s swearing-in.

Technical Overview

DXY

Bitcoin initiated an uptrend with Trump officially taking office, reaching as high as $109,000. Setting a new all-time high, BTC is expected to extend its bullish trend to $123,194 with daily closes above the $108,286 region.

Resistance: 118,500 / 123,550 / 131,029

Support: 108,985 / 92,000 / 88,362

BTC/USD

Bitcoin’s recovery is ongoing, with momentum from a horizontal support level pushing it close to $100,000. Breaking the descending resistance level could extend Bitcoin’s uptrend to the $108,186 region.

Resistances: 108,985 / 118,500 / 123,550

Supports: 92,000 / 88,362 / 83,365

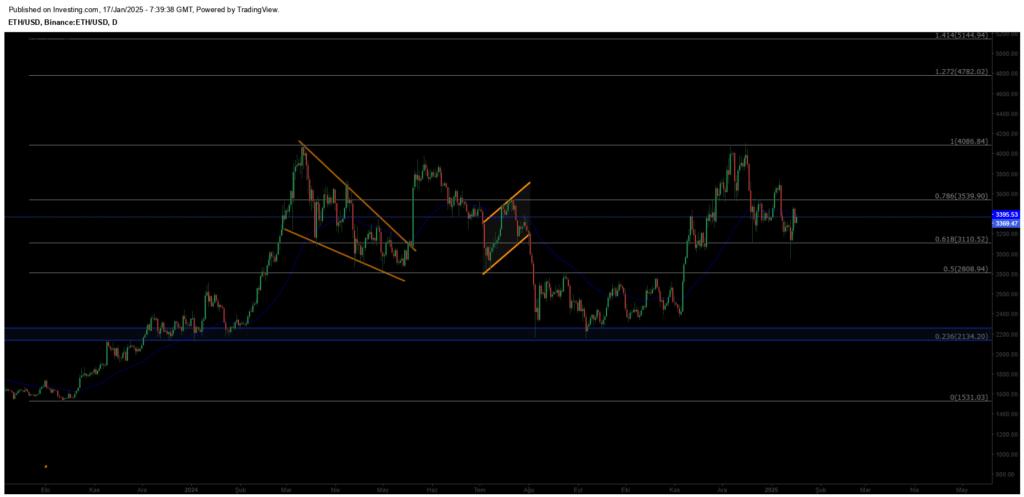

ETH/USD

Ethereum has seen a long-awaited rise, reaching $3,400. The next critical resistance zone to monitor is $3,539. A strong breakout above this level could further sustain Ethereum’s uptrend.

Resistances: 3,539 / 4,086 / 4,782

Supports: 3,110 / 2,808 / 2,134

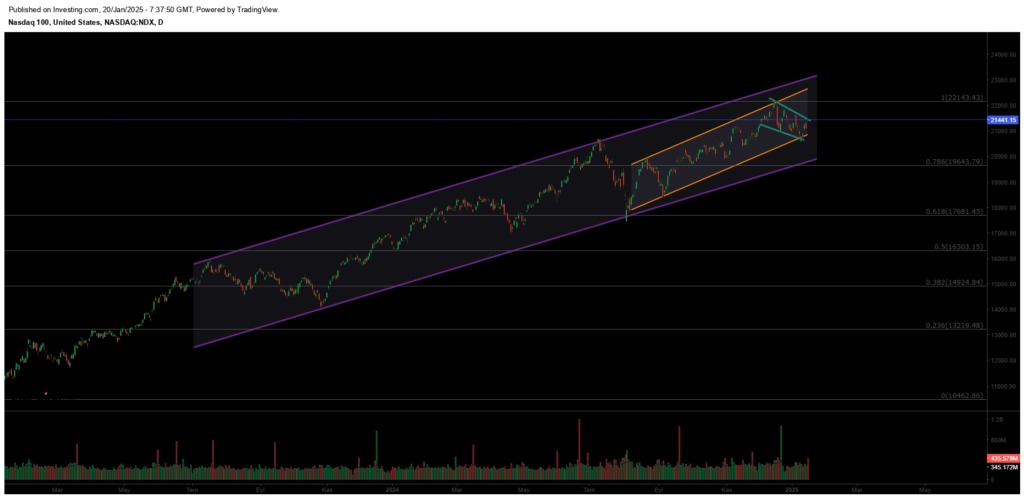

NASDAQ

The index’s uptrend continues to strengthen within the ascending channel structure on weekly charts. Short-term declines could lead to resistance breakouts, potentially driving the index back to 22,143 in the near term. The key support zone to watch for pullbacks is 19,643.

Resistances: 22,143 / 25,320 / 26,979

Supports: 19,643 / 17,681 / 16,303

BRENT

Brent Crude is experiencing medium-term recoveries and has regained its previously lost channel structure, continuing its uptrend. Having surpassed the 76.98 resistance level, prices are expected to climb toward the 85.00 range if sustained above this level. Key support during pullbacks is 72.37.

Resistances: 85.84 / 95.53 / 102.43

Supports: 80.00 / 76.15 / 70.17

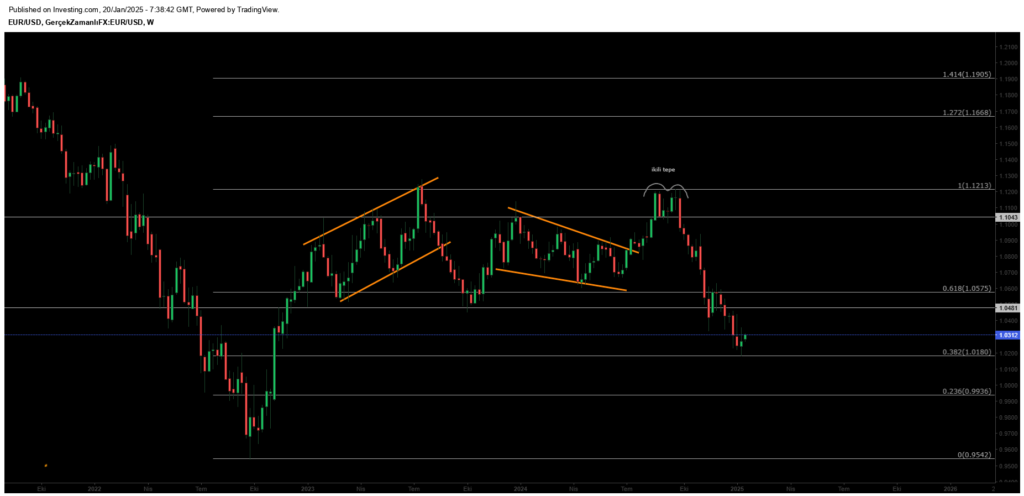

EURUSD

The Euro formed a double top at the 1.11 level and entered a downtrend. After breaking below the 1.10 support, it has retreated to the lower band of its channel at 1.0367. Buyers may step in at this critical support, but a break lower could see further declines to 1.018.

Resistance Levels: 1.0575 / 1.1043 / 1.1213

Support Levels: 1.0180 / 0.9936 / 0.9542

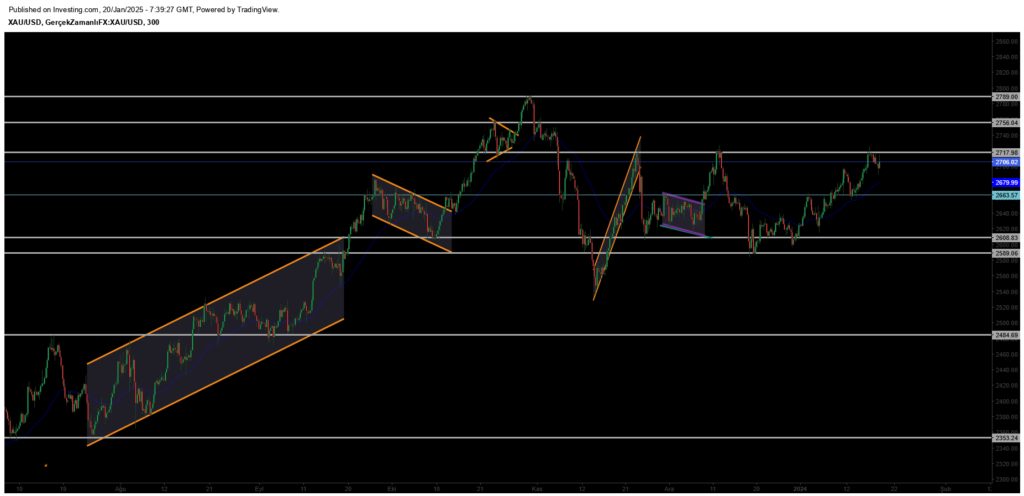

XAUUSD

Gold has gained momentum after rebounding from the 2610 support zone, resuming its upward trend. Breaking through the key resistance at the 2666 level with strong volume, it continues its bullish path. However, it may retest the recently broken resistance level. In case of a pullback, 2665 will serve as a key support zone to monitor.

Resistance Levels: 2717 / 2756 / 2790

Support Levels: 2666 / 2589 / 2550

Leave A Comment