💵 💴 💶

Trump Media Group Takes Steps Toward Cryptocurrency Payment Services 💴 💶

Trump Media & Technology Group has recently come into focus with a trademark application. The group is currently exploring the development of a cryptocurrency payment platform.

The application, submitted on Monday by Donald Trump’s social media company, outlines plans for a service called TruthFi. The proposed platform aims to offer cryptocurrency payments, financial custody, and digital asset trading.

Gary Gensler to Step Down as SEC Chair in January 2025

Gary Gensler will step down as SEC Chair on January 20, 2025, according to a statement from the agency on Thursday. Since taking office in April 2021, Gensler has spearheaded numerous regulatory challenges for the crypto industry. He also introduced reforms for executive compensation tied to company performance and tightened protections for investors in cryptocurrency markets.

CBRT’s Net International Reserves Fell by $1.67 Billion Last Week, Dropping to $59.06 BillionThe Central Bank of the Republic of Turkey (CBRT)’s net international reserves fell by $1.67 billion in the week ending November 15, bringing the total to $59.06 billion. According to the weekly data released by the CBRT, net foreign exchange reserves decreased for the second consecutive week. After a $21.42 billion increase between mid-September and late October, the first two weeks of November recorded a total decline of $2.1 billion.

Technical Overview

DXY

The US Dollar Index (DXY) continues its upward trend, starting the week with a strong recovery. Finding support at the critical 106.50 level, the DXY is expected to maintain its bullish momentum as long as it remains above this zone. Buyers appear to dominate this area, and the index is likely to move towards resistance levels.

Resistance Levels: 108.00 / 110.00 / 115.76

Support Levels: 106.50 / 102.26 / 100.68

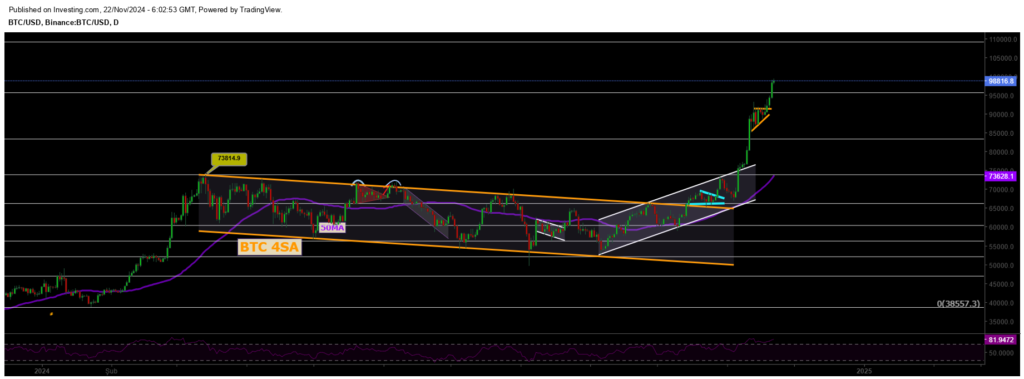

BTC/USD

Bitcoin has reached the resistance of the descending channel structure and successfully broke through with significant volume. This resistance zone is crucial for BTC and could open the doors to a new bullish trend in the cryptocurrency markets. If Bitcoin manages to sustain its price above this strategic level, we may see bullish momentum for Bitcoin and other altcoins, triggering a rally that gains traction in the market. Therefore, the current levels represent a critical turning point that should be closely monitored.

Resistances: 68,350 / 71,927 / 75,000

Supports: 66,148 / 64,290 / 60,000

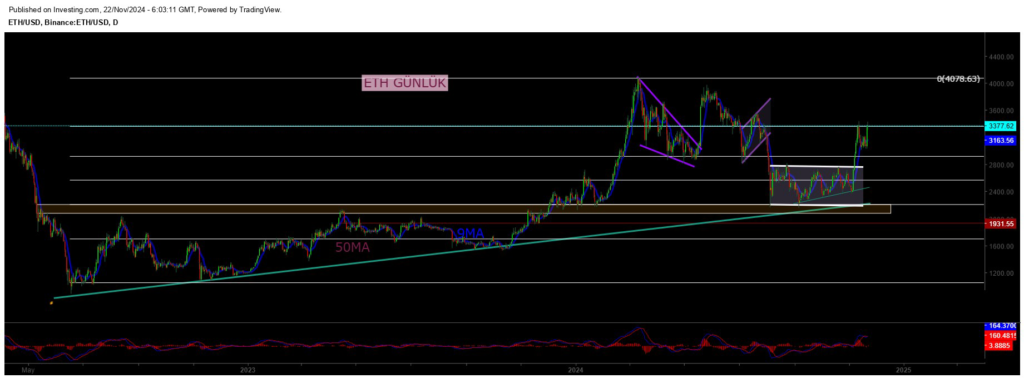

ETH/USD

ETHUSD continues to trade within the descending channel pattern, remaining under pressure. After losing its horizontal major support, ETHUSD is now priced around the 2400 level. If selling deepens, the critical support level to watch is 2100, where buyers are expected to strengthen. On the other hand, for the upward trend in ETH to continue, it needs to close decisively above the major resistance at 2922 with strong volume. If this resistance is breached, a new uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

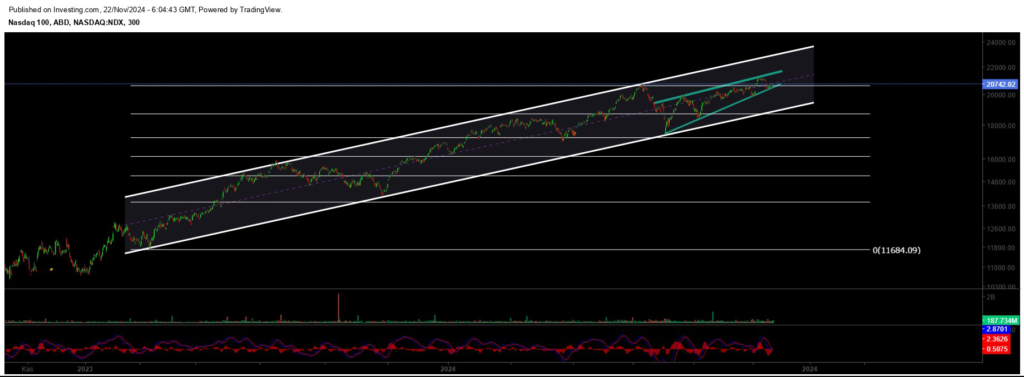

NASDAQ

The index, continuing its upward trend, is pricing above the 20,635 resistance level, maintaining its bullish momentum. In the event of potential pullbacks, two critical support levels stand out. Firstly, the 19,600 level serves as an important support zone in the short term. In case of a deeper pullback, the 18,400 level should be monitored as a strong buying area. Buyers are expected to step in at these levels.

Resistances: 20,635 / 22,400 / 23,000

Supports: 18,913 / 18,670 / 17,200

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

EURUSD

The Euro formed a double top at the 1.11 level, signaling the potential onset of a downtrend, as we anticipated. Following the loss of the 1.10 support level, the price retraced to the lower boundary of the channel structure at the 1.07 level. This move further extended after the break of the rising support, pulling the Euro down to 1.046.As of today, it seems highly likely that Buyers will step back into the market from this critical support level. However, if this support is breached, a deeper retracement towards the 1.099 level could become possible for the Euro. Technically, the market’s reaction at these levels will be pivotal in determining the next direction of movement. Therefore, the price action on the Euro front should be closely monitored.

Resistance Levels: 1.114 / 1.130 / 1.135

Support Levels: 1.040 / 1.020 / 0.990

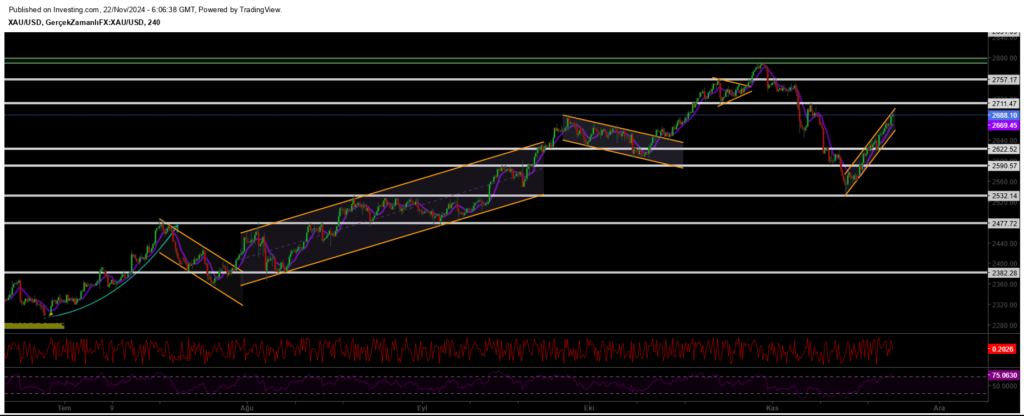

XAUUSD

Gold surpassed the 2,742 resistance zone, reaching a new all-time high and heading strongly towards the 2,800 level. In this uptrend, the 2,745 level stands out as a key support; as long as gold stays above this level, it could maintain its upward momentum. As it moves towards the 2,800 target, investors should closely watch whether gold continues to trade above this support zone.

Resistances: 2800 / 2850 / 2910

Supports: 2740 / 2690 / 2625

Leave A Comment