💵 💴 💶Trump Signs Executive Order Promoting Cryptocurrency and Digital Asset Stock💴 💶

President Donald Trump has fulfilled his pre-election promise to the crypto world by signing an executive order aimed at advancing cryptocurrency development in the U.S. and potentially creating a national digital asset reserve. Venture capitalist David Sacks, appointed by Trump as the crypto and AI czar, joined him in the Oval Office during the signing. The order states, “The digital asset industry plays a critical role in fostering innovation and economic growth in the United States, as well as contributing to our nation’s global leadership.” A key part of the order focuses on forming a task force to evaluate the development of a national digital asset reserve derived “legally through cryptocurrencies seized by Federal Government enforcement agencies.” Bitcoin (BTC) saw a 0.8% increase this morning, reaching $103,935.

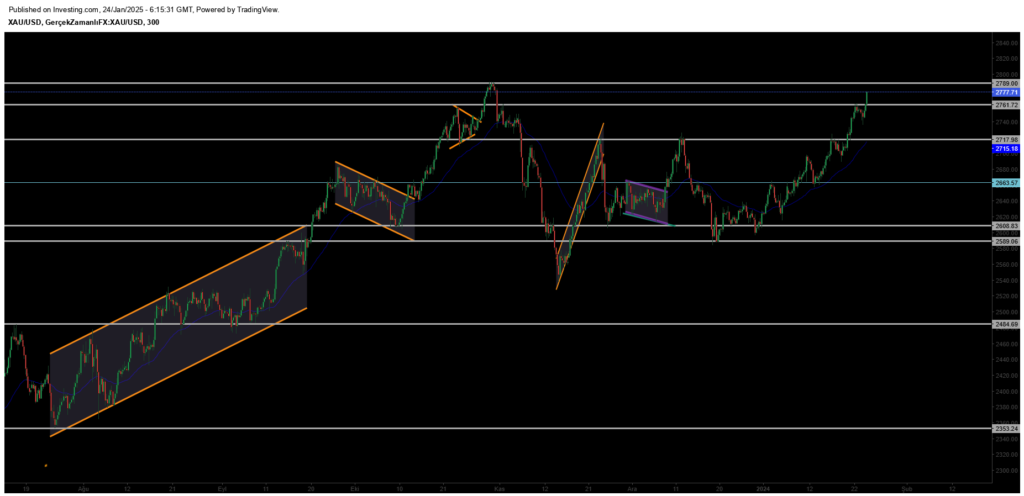

Gold Ounce Nears Record High Amid Fed Rate Speculations

Comments from President Trump suggesting he might pressure the Federal Reserve to lower interest rates have weakened the U.S. dollar, benefiting gold. Gold ounce prices are steadily moving toward their all-time high of $2,790. This morning, gold reached $2,777.41, currently trading at $2,773.20—up 0.7% from yesterday. Over the past week, gold has risen 2.8%, with a year-to-date increase of 5.7%.

GLOBAL MARKETS

Global stock markets are on the rise due to expectations of U.S. interest rate cuts and optimism about a potential trade agreement between the U.S. and China. The Bank of Japan (BOJ) raised its policy rate by 25 basis points, moving from 0.25% to 0.5%, the highest level since the 2008 global financial crisis. BOJ’s move reflects confidence that rising wages will stabilize inflation around its 2% target. Following the announcement, mixed trading was observed in the yen.

Technical Overview

DXY

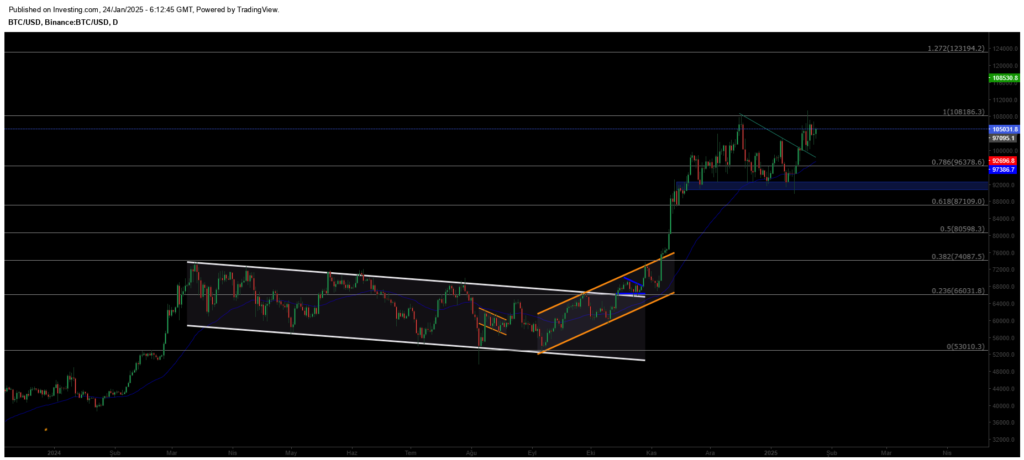

Bitcoin initiated an uptrend with Trump officially taking office, reaching as high as $109,000. Setting a new all-time high, BTC is expected to extend its bullish trend to $123,194 with daily closes above the $108,286 region.

Resistance: 118,500 / 123,550 / 131,029

Support: 108,985 / 92,000 / 88,362

BTC/USD

Bitcoin surged to $109,000 following Donald Trump’s official return to office, but faced selling pressure after failing to sustain above the $108,286 level. If BTC closes above the $108,186 resistance, it could climb further to $123,194.

Resistance: 108,985 / 118,500 / 123,550

Support: 92,000 / 88,362 / 80,598

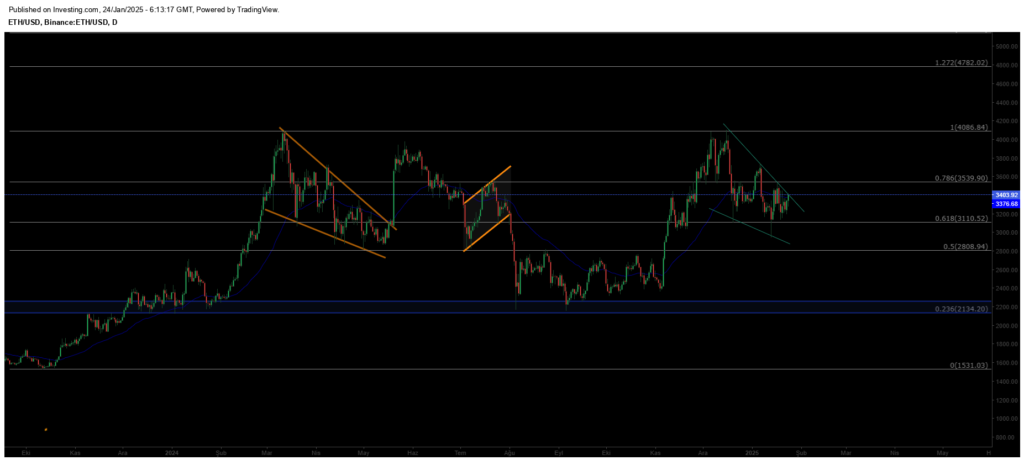

ETH/USD

Ethereum has seen a long-awaited rise, reaching $3,400. The next critical resistance zone to monitor is $3,539. A strong breakout above this level could further sustain Ethereum’s uptrend.

Resistances: 3,539 / 4,086 / 4,782

Supports: 3,110 / 2,808 / 2,134

NASDAQ

The index’s uptrend continues to strengthen within the ascending channel structure on weekly charts. Short-term declines could lead to resistance breakouts, potentially driving the index back to 22,143 in the near term. The key support zone to watch for pullbacks is 19,643.

Resistances: 22,143 / 25,320 / 26,979

Supports: 19,643 / 17,681 / 16,303

BRENT

Brent Crude is experiencing medium-term recoveries and has regained its previously lost channel structure, continuing its uptrend. Having surpassed the 76.98 resistance level, prices are expected to climb toward the 85.00 range if sustained above this level. Key support during pullbacks is 72.37.

Resistances: 85.84 / 95.53 / 102.43

Supports: 80.00 / 76.15 / 70.17

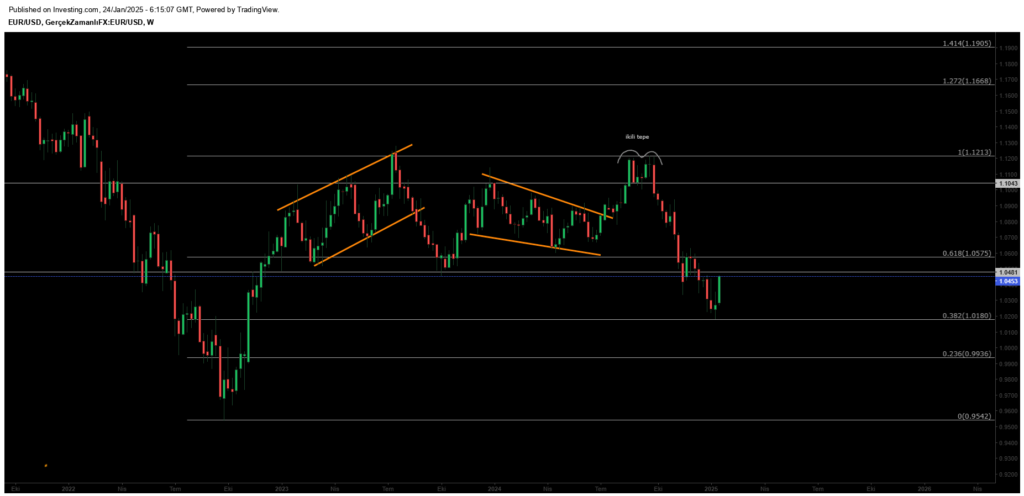

EURUSD

The Euro formed a double top at the 1.11 level and entered a downtrend. After breaking below the 1.10 support, it has retreated to the lower band of its channel at 1.0367. Buyers may step in at this critical support, but a break lower could see further declines to 1.018.

Resistance Levels: 1.0575 / 1.1043 / 1.1213

Support Levels: 1.0180 / 0.9936 / 0.9542

XAUUSD

Gold rebounded from the 2,666 support level and resumed its uptrend, breaking the 2,717 resistance. Pullbacks to test the broken resistance at 2,717 could be buying opportunities, with the uptrend expected to continue.

Resistances: 2790 / 2800 / 2850

Supports: 2756 / 2717 / 2666

Leave A Comment