💵 💴 💶Bernstein’s $200,000 Bitcoin Prediction: This Figure May Be Low💵 💴 💶

Analysts noted in their September 2023 “Bitcoin Blackbook” report that their price prediction of $200,000 might end up being too conservative. They stated: “If you have doubts about Bitcoin… Perhaps in a time when U.S. government debt is at record levels, you might reconsider and think that this asset with limited supply and value storage might not be such a bad investment.” The customer note also mentioned that those with doubts about Bitcoin and hesitations in buying may turn to shares of companies like MicroStrategy and mining firms. Bitcoin mining companies such as RIOT and Cleanspark were recommended due to their access to energy resources, while Core Scientific was suggested for its “hosting” services provided to artificial intelligence firms.

U.S. Stock Markets Close Negative on Interest Rate Concerns

The U.S. stock markets today were under pressure due to losses in mega-cap stocks and growing concerns over rising yields in Treasury bonds. The yield on the 2-year Treasury bond rose to 4.09%, while the 10-year bond yield reached 4.25%. Moreover, the ongoing selling pressure and disappointing 20-year bond issuance increased this week’s losses, limiting the interest in buying stocks at lower levels. Although the Dow Jones Industrial Average fell by more than 500 points, stocks managed to recover from their worst levels of the day. However, a lack of a driving force in the market and a general lack of buyer interest also reflected in commodity markets, especially in oil and precious metals.

Yesterday, oil prices gained strength without major developments. ICE Brent rose by 2.4%, exceeding $76. However, this morning prices are under some pressure. Yesterday’s rise could be a response to the lack of results from U.S. Secretary of State Antony Blinken’s visit to Israel. A reduction in tensions was expected after Hamas leader Yahya Sinwar’s assassination. Additionally, the market is closely watching how Israel will respond to Iran’s missile attack. This uncertainty is preventing speculators from taking short positions in the market. Recently, due to demand concerns and a downward trend for 2025, speculators had been holding short positions.

Technical Overview

DXY

The US Dollar Index (DXY) is continuing its upward trend with a strong recovery at the beginning of the week. Finding strength from the critical support level at 100.68, the DXY is expected to maintain its bullish momentum as long as it stays above this support. Notably, as long as it trades above the 100.68 level, upward movements are likely to accelerate. Buyers appear to be dominant in this area, and the index seems poised to move toward resistance levels.

Resistance Levels: 102.26 / 103.23 / 104.02

Support Levels: 100.68 / 98.00 / 97.00

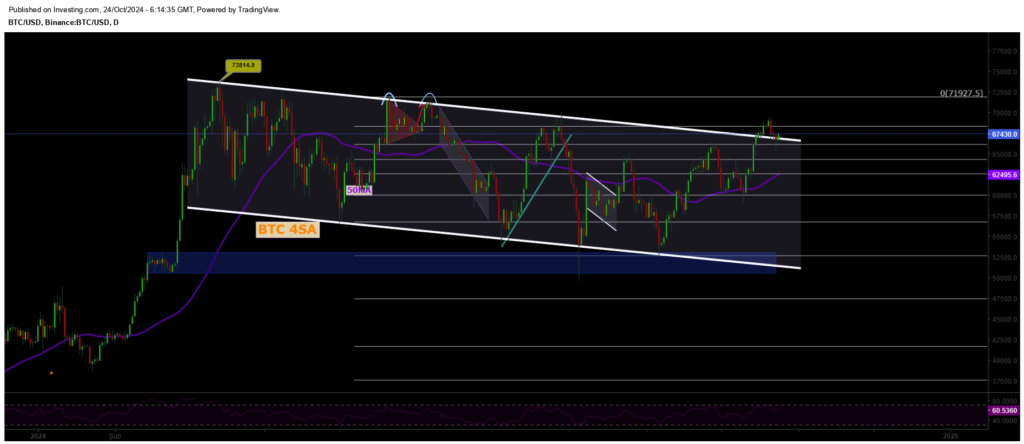

BTC/USD

The pullback in BTCUSD continues. After the Iran-Israel incident, we saw declines in cryptocurrencies. The support level to watch is around the 60,000 region.Resistance

Resistances: 68,350 / 71,927 / 75,000

supports: 66,148 / 64,290 / 60,000

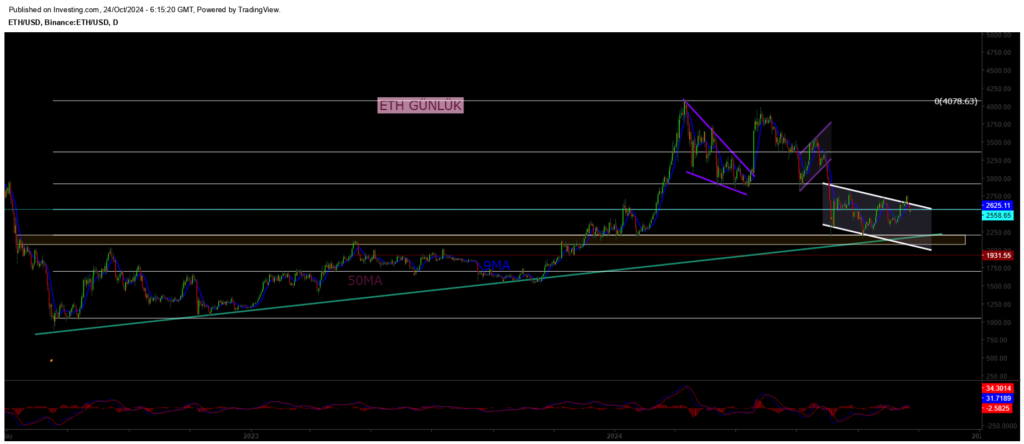

ETH/USD

ETHUSD continues to trade within the descending channel pattern, remaining under pressure. After losing its horizontal major support, ETHUSD is now priced around the 2400 level. If selling deepens, the critical support level to watch is 2100, where buyers are expected to strengthen. On the other hand, for the upward trend in ETH to continue, it needs to close decisively above the major resistance at 2922 with strong volume. If this resistance is breached, a new uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

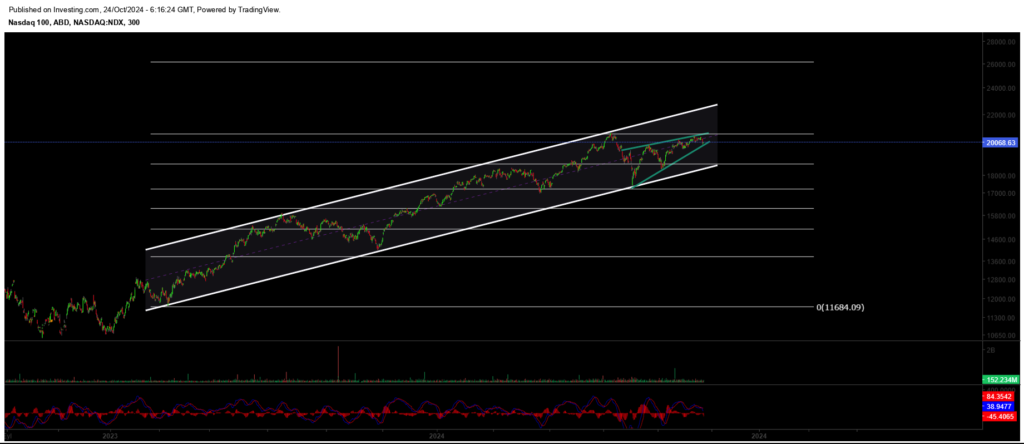

NASDAQ

The index continues its upward trend, and if it manages to hold above the 20,370 resistance level, the upward movement could accelerate. A break of this level would take the index towards the upper band of the ascending channel that has been forming since March 2023. In the event of a pullback, two critical support levels should be noted: the first being 19,600 as a significant short-term support, and in case of a deeper decline, the strong buying zone at 18,400 should be monitored. Buyers are expected to step in at these levels.

Resistances: 19,900 / 20,000 / 20,985

Supports: 18,913 / 18,500 / 18,160

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

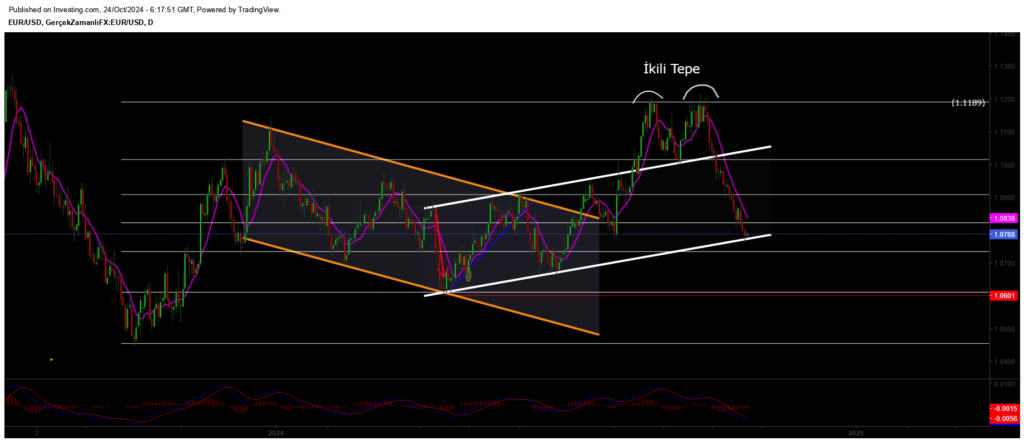

EURUSD

EUR/USD successfully broke through its ascending channel resistance and has been trading above both horizontal and channel resistance. It held above the 1.0983 resistance zone and reached our target of 1.114. However, facing selling pressure around 1.11, it lost this zone, creating a “deviation” and leading to a pullback. Now, the critical support level to watch for EUR/USD is 1.0983. Maintaining this level is crucial for stabilizing the price.

Resistances: 1.114 / 1.130 / 1.135

Supports: 1.098 / 1.088 / 1.080

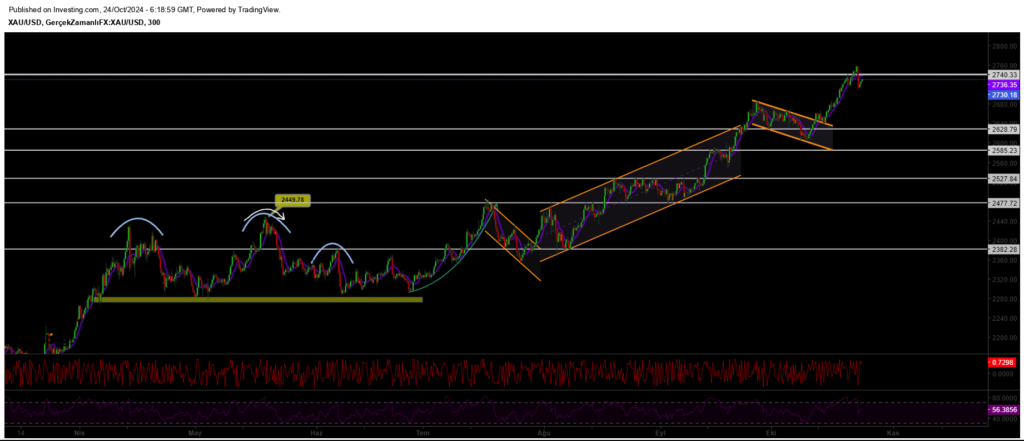

XAUUSD

XAUUSD, after gaining momentum from the support of the descending channel, has successfully broken through the resistance of the descending channel. As long as it continues to hold above this broken resistance area, gold could potentially reach a new all-time high (ATH) and extend its upward trend for a while. Particularly, maintaining stability above this resistance zone will accelerate the upward movement of gold.

Resistances: 2690 / 2740 / 2800

Supports: 2625 / 2585 / 2527

Leave A Comment