💵 💴 💶GLOBAL MARKETS💵 💴 💶

Following Japan’s elections, where the ruling party lost its majority in parliament, the yen fell to a three-month low, while oil prices dropped after Israel’s retaliatory strikes on Iran resulted in minimal damage to oil and nuclear facilities. Israel’s strikes, which targeted missile factories and other facilities near Tehran over the weekend, avoided disrupting energy supplies. Consequently, the nearest Brent crude oil contract BRN1! dropped by 4.2%, falling to $71.99 per barrel. Following Japan’s election results, which saw the Liberal Democratic Party (LDP) record its weakest outcome since 2009, Japan’s Nikkei index NI225 initially declined but then rebounded by 1.83%.

Michael Saylor’s “Bitcoin Proposal” to Microsoft CEO

Bitcoin advocate Michael Saylor has made an appeal to Microsoft CEO Satya Nadella, suggesting that Microsoft could greatly benefit by adding Bitcoin to its treasury. This proposal aligns with a similar shareholder suggestion. Saylor emphasized the success of the Bitcoin strategy for his company, MicroStrategy, which holds 252,220 BTC, valued at over $17 billion. This strategy has propelled MicroStrategy’s shares to a 25-year high, reaching $235.89. Saylor believes that adopting a similar strategy could be highly profitable for a large company like Microsoft.

Is BRICS Summit’s Bitcoin Plan Still On?Discussions continue around the role Bitcoin and cryptocurrencies might play in BRICS’ plans to reduce the role of the U.S. dollar. Previously, it was suggested that Russia could bypass Western sanctions by using Bitcoin. However, BRICS has yet to officially confirm any plan to incorporate Bitcoin. Nonetheless, the alliance is exploring a blockchain-based payment system to facilitate cross-border payments. How stablecoins might play a role in this process in the future is also being closely watched.

Technical Overview

DXY

The Dollar Index (DXY) is strongly recovering at the start of the week, continuing its upward trend. Finding strength at the critical support level of 100.68, the DXY is expected to maintain its upward momentum as long as it stays above this support. Especially as it trades above the 106.68 level, upward movements are anticipated to accelerate. Buyers are observed to be dominant in this area, and the index is likely to advance toward resistance levels.

Resistances: 104.76 / 106.00 / 107.35

Supports: 104.02 / 102.26 / 100.68

BTC/USD

The pullback in BTCUSD continues. After the Iran-Israel incident, we saw declines in cryptocurrencies. The support level to watch is around the 60,000 region.Resistance

Resistances: 68,350 / 71,927 / 75,000

supports: 66,148 / 64,290 / 60,000

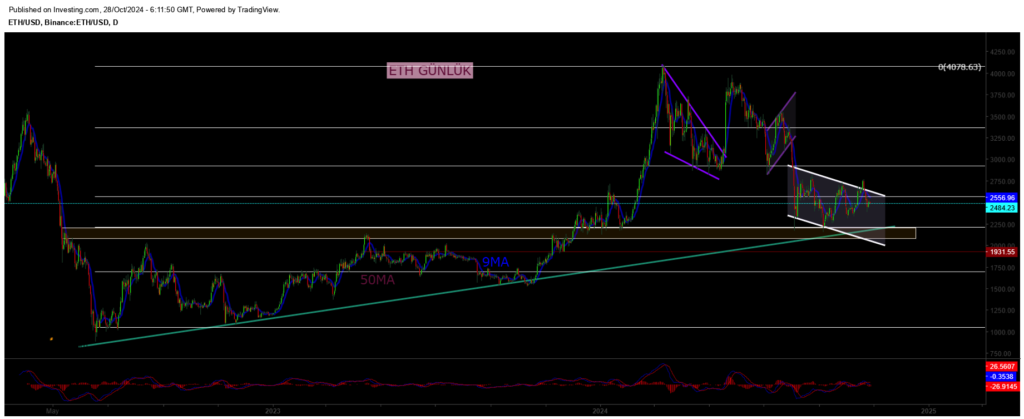

ETH/USD

ETHUSD continues to trade within the descending channel pattern, remaining under pressure. After losing its horizontal major support, ETHUSD is now priced around the 2400 level. If selling deepens, the critical support level to watch is 2100, where buyers are expected to strengthen. On the other hand, for the upward trend in ETH to continue, it needs to close decisively above the major resistance at 2922 with strong volume. If this resistance is breached, a new uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

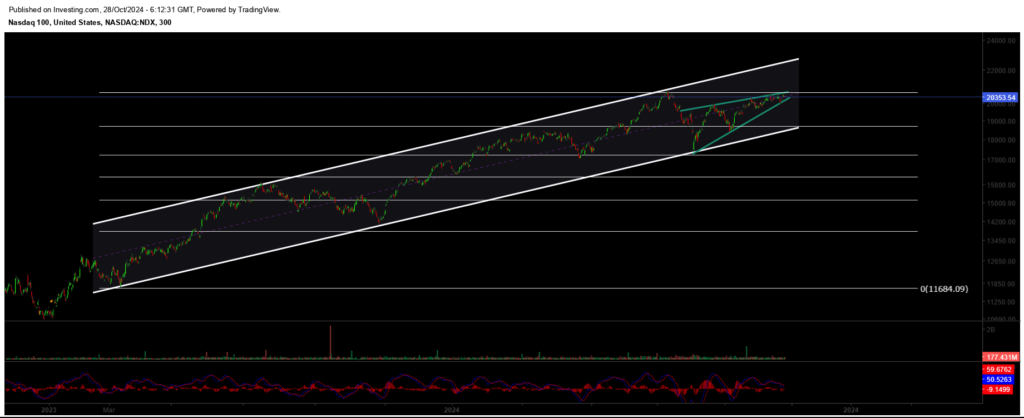

NASDAQ

The index continues its upward trend, and if it manages to hold above the 20,370 resistance level, the upward movement could accelerate. A break of this level would take the index towards the upper band of the ascending channel that has been forming since March 2023. In the event of a pullback, two critical support levels should be noted: the first being 19,600 as a significant short-term support, and in case of a deeper decline, the strong buying zone at 18,400 should be monitored. Buyers are expected to step in at these levels.

Resistances: 19,900 / 20,000 / 20,985

Supports: 18,913 / 18,500 / 18,160

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

EURUSD

EUR/USD successfully broke through its ascending channel resistance and has been trading above both horizontal and channel resistance. It held above the 1.0983 resistance zone and reached our target of 1.114. However, facing selling pressure around 1.11, it lost this zone, creating a “deviation” and leading to a pullback. Now, the critical support level to watch for EUR/USD is 1.0983. Maintaining this level is crucial for stabilizing the price.

Resistances: 1.114 / 1.130 / 1.135

Supports: 1.098 / 1.088 / 1.080

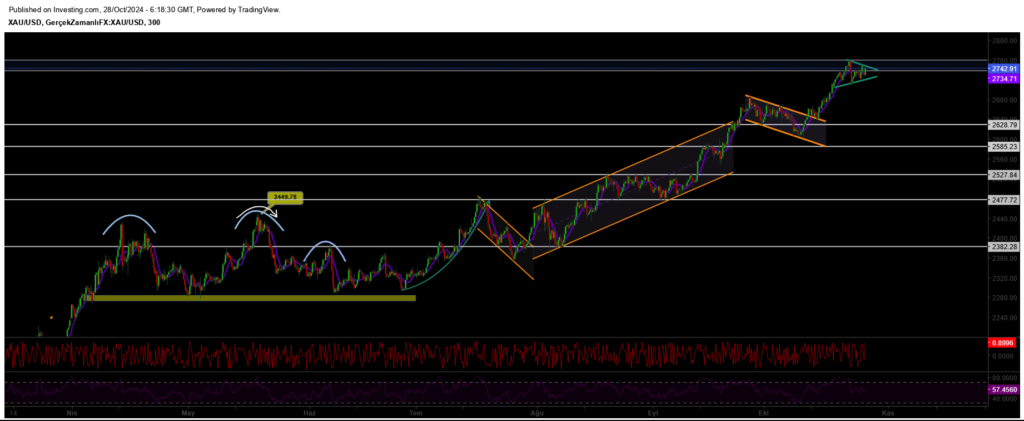

XAUUSD

XAUUSD, after gaining momentum from the support of the descending channel, has successfully broken through the resistance of the descending channel. As long as it continues to hold above this broken resistance area, gold could potentially reach a new all-time high (ATH) and extend its upward trend for a while. Particularly, maintaining stability above this resistance zone will accelerate the upward movement of gold.

Resistances: 2690 / 2740 / 2800

Supports: 2625 / 2585 / 2527

Leave A Comment