💵 💴 💶GLOBAL MARKETS💵 💴 💶

Financial markets started the week cautiously, with Asian markets trending upwards, while the dollar slightly declined ahead of the U.S. presidential election. This week, alongside the presidential election, the U.S. Federal Reserve (Fed), the Bank of England (BoE), the Swedish Central Bank, and the Norwegian Central Bank are all set to announce interest rate decisions. The Fed, starting its meeting a day after the election, is expected to announce a 25-basis point interest rate cut.

Fed’s 25 Basis Point Cut

Although Tuesday’s election is the primary focus for the market, Thursday’s Federal Reserve policy decision is expected to have a significant impact as well. A 25-basis point rate cut is widely anticipated and has been priced in. However, Fed Chair Powell’s comments on the current economic situation and the potential impact of the next U.S. president on the broader outlook will be of major importance to the markets.

European Stocks Expected to Open Slightly HigherWith all eyes on the U.S. presidential election, European stocks are expected to start the week slightly up. In addition to the U.S. election, European markets will keep an eye on European manufacturing PMI data and the third-quarter results from companies.

According to IG data, the UK’s FTSE 100 index is expected to open down by 4 points at 8,173, Germany’s DAX index is set to open up by 11 points at 19,261, France’s CAC index by 2 points at 7,415, and Italy’s FTSE MIB index by 74 points at 34,507. European futures markets are showing mixed movements this morning, with the FDAX up by 0.11% and the Eurostoxx 50 futures index up by 0.1%. The FTSE 100 futures index, however, is down by 0.1%.

Technical Overview

DXY

The Dollar Index (DXY) is strongly recovering at the start of the week, continuing its upward trend. Finding strength at the critical support level of 100.68, the DXY is expected to maintain its upward momentum as long as it stays above this support. Especially as it trades above the 106.68 level, upward movements are anticipated to accelerate. Buyers are observed to be dominant in this area, and the index is likely to advance toward resistance levels.

Resistances: 104.76 / 106.00 / 107.35

Supports: 104.02 / 102.26 / 100.68

BTC/USD

Bitcoin has reached the resistance of the descending channel structure and successfully broke through with significant volume. This resistance zone is crucial for BTC and could open the doors to a new bullish trend in the cryptocurrency markets. If Bitcoin manages to sustain its price above this strategic level, we may see bullish momentum for Bitcoin and other altcoins, triggering a rally that gains traction in the market. Therefore, the current levels represent a critical turning point that should be closely monitored.

Resistances: 68,350 / 71,927 / 75,000

Supports: 66,148 / 64,290 / 60,000

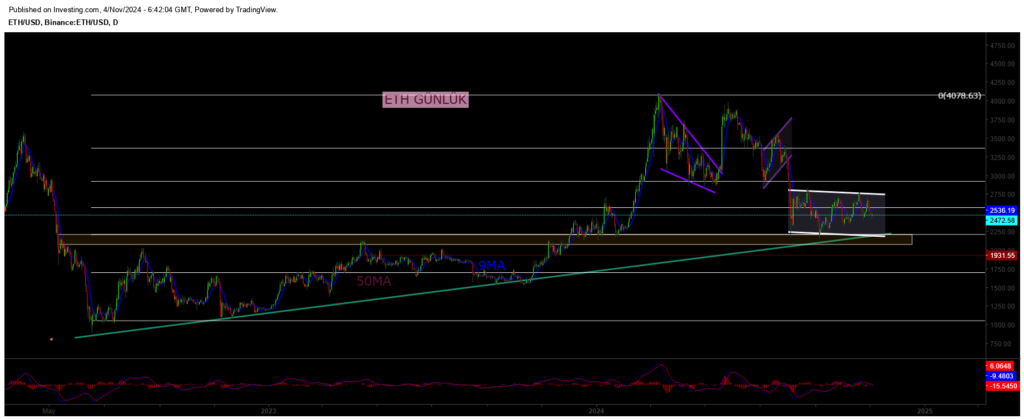

ETH/USD

ETHUSD continues to trade within the descending channel pattern, remaining under pressure. After losing its horizontal major support, ETHUSD is now priced around the 2400 level. If selling deepens, the critical support level to watch is 2100, where buyers are expected to strengthen. On the other hand, for the upward trend in ETH to continue, it needs to close decisively above the major resistance at 2922 with strong volume. If this resistance is breached, a new uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

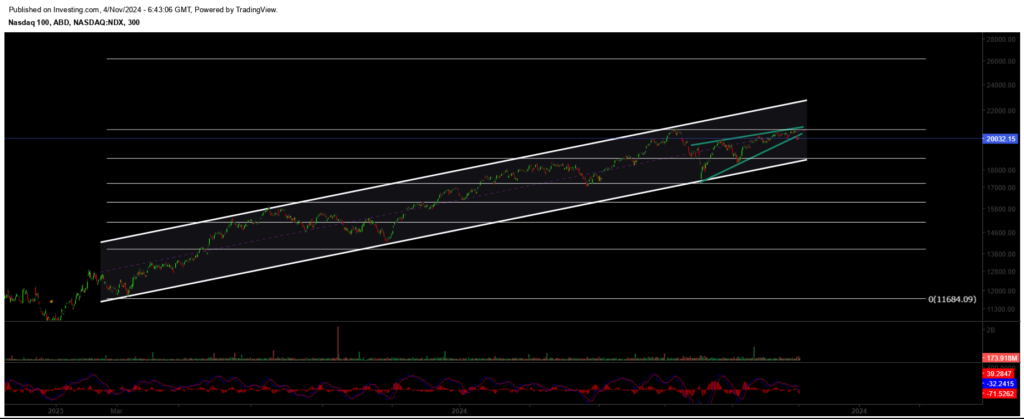

NASDAQ

The index, continuing its uptrend, may accelerate its upward movement if it prices above the 20,635 resistance level. Breaking through this level could push the index towards the upper band of the rising channel structure formed since March 2023. In case of a pullback, two key support levels come into focus: in the short term, the 19,600 level is a significant support zone. For a deeper correction, the 18,400 level serves as a strong buying area, where buyers are expected to step in.

Resistances: 20,635 / 22,400 / 23,000

Supports: 18,913 / 18,670 / 17,200

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

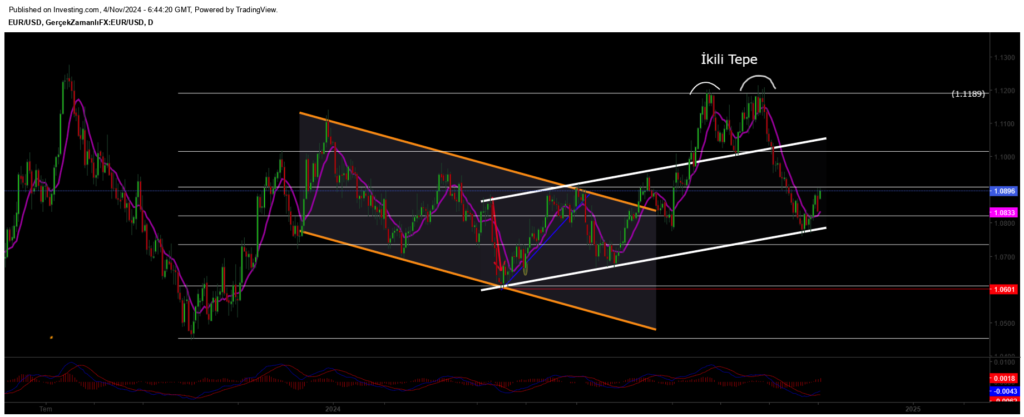

EURUSD

EUR/USD successfully broke through its ascending channel resistance and has been trading above both horizontal and channel resistance. It held above the 1.0983 resistance zone and reached our target of 1.114. However, facing selling pressure around 1.11, it lost this zone, creating a “deviation” and leading to a pullback. Now, the critical support level to watch for EUR/USD is 1.0983. Maintaining this level is crucial for stabilizing the price.

Resistances: 1.114 / 1.130 / 1.135

Supports: 1.098 / 1.088 / 1.080

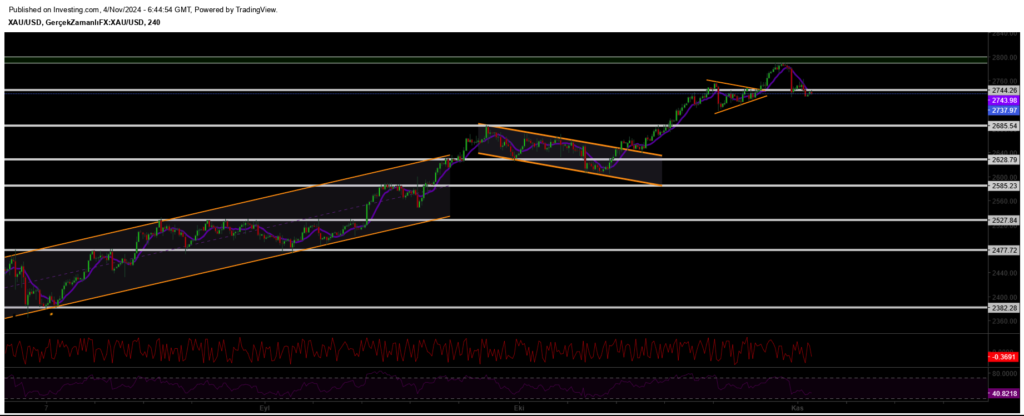

XAUUSD

Gold surpassed the 2,742 resistance zone, reaching a new all-time high and heading strongly towards the 2,800 level. In this uptrend, the 2,745 level stands out as a key support; as long as gold stays above this level, it could maintain its upward momentum. As it moves towards the 2,800 target, investors should closely watch whether gold continues to trade above this support zone.

Resistances: 2800 / 2850 / 2910

Supports: 2740 / 2690 / 2625

Leave A Comment