💵 💴 💶

Israel and Lebanon on the Verge of a Ceasefire Agreement – Axios💴 💶

According to information provided to Axios by two senior Israeli officials and two U.S. officials, Israel and Lebanon are on the brink of a ceasefire agreement that would end the Israel-Hezbollah conflict. The draft agreement includes a 60-day transition period during which the Israeli military would withdraw from southern Lebanon, the Lebanese army would deploy near the border, and Hezbollah would move its heavy weaponry north of the Litani River.

Israeli and U.S. officials said that the U.S. has agreed to provide Israel with a letter of assurance supporting Israeli military action against potential immediate threats from Lebanese territory. The letter also ensures U.S. support for actions to prevent Hezbollah from re-establishing military presence near the border or engaging in heavy arms smuggling.

Gary Gensler to Step Down as SEC Chair in January 2025

Gary Gensler will step down as SEC Chair on January 20, 2025, according to an announcement made by the agency on Thursday. Since taking office in April 2021, Gensler has spearheaded several challenging regulatory initiatives targeting the crypto industry. He also introduced reforms on executive compensation tied to corporate performance and tightened investor protections within cryptocurrency markets.

Bitcoin ETFs Close to Surpassing Satoshi Nakamoto’s BTC Stash

Since their launch in January, U.S. spot Bitcoin ETFs have experienced significant growth. According to crypto analyst HODL15Capital, these funds currently hold approximately 1.081 million Bitcoin, just shy of Satoshi Nakamoto’s estimated 1.1 million holdings.

Satoshi Nakamoto, Bitcoin’s anonymous creator, is believed to hold about 5.68% of the total Bitcoin supply. These assets, worth over $100 billion, place Nakamoto among the world’s wealthiest individuals—if alive and a single person. However, Bloomberg’s Senior ETF Analyst Eric Balchunas noted that ETFs are now 98% close to surpassing Nakamoto’s holdings. If the current growth rate continues, this milestone could be achieved by Thanksgiving.

Technical Overview

DXY

The Dollar Index (DXY) is strongly recovering at the start of the week, continuing its upward trend. Finding strength at the critical support level of 100.68, the DXY is expected to maintain its upward momentum as long as it stays above this support. Especially as it trades above the 106.68 level, upward movements are anticipated to accelerate. Buyers are observed to be dominant in this area, and the index is likely to advance toward resistance levels.

Resistances: 104.76 / 106.00 / 107.35

Supports: 104.02 / 102.26 / 100.68

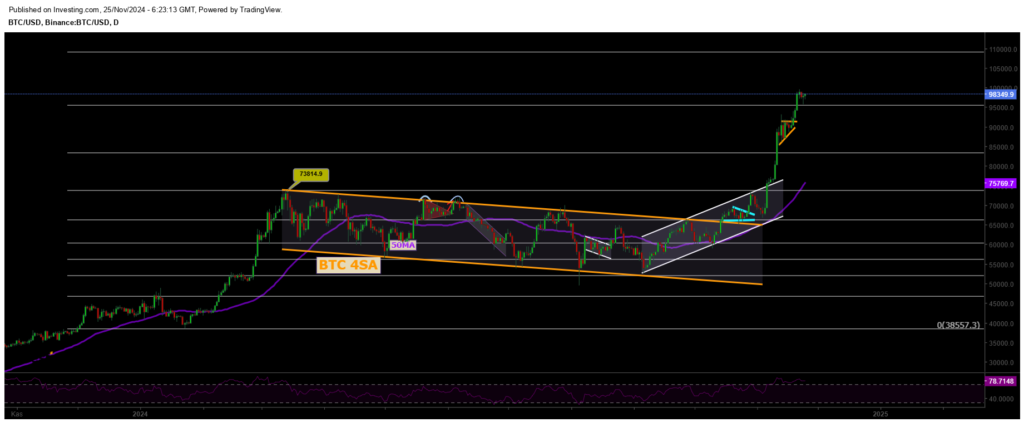

BTC/USD

Bitcoin has reached the resistance of the descending channel structure and successfully broke through with significant volume. This resistance zone is crucial for BTC and could open the doors to a new bullish trend in the cryptocurrency markets. If Bitcoin manages to sustain its price above this strategic level, we may see bullish momentum for Bitcoin and other altcoins, triggering a rally that gains traction in the market. Therefore, the current levels represent a critical turning point that should be closely monitored.

Resistances: 68,350 / 71,927 / 75,000

Supports: 66,148 / 64,290 / 60,000

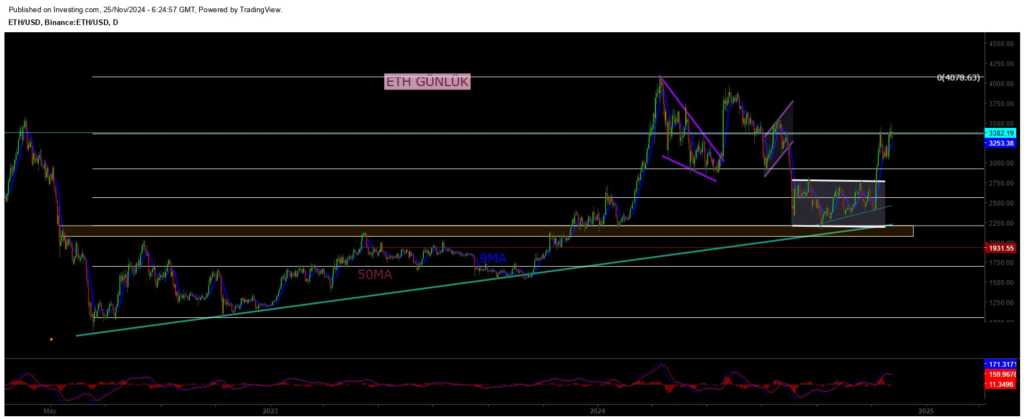

ETH/USD

ETHUSD continues to trade within the descending channel pattern, remaining under pressure. After losing its horizontal major support, ETHUSD is now priced around the 2400 level. If selling deepens, the critical support level to watch is 2100, where buyers are expected to strengthen. On the other hand, for the upward trend in ETH to continue, it needs to close decisively above the major resistance at 2922 with strong volume. If this resistance is breached, a new uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

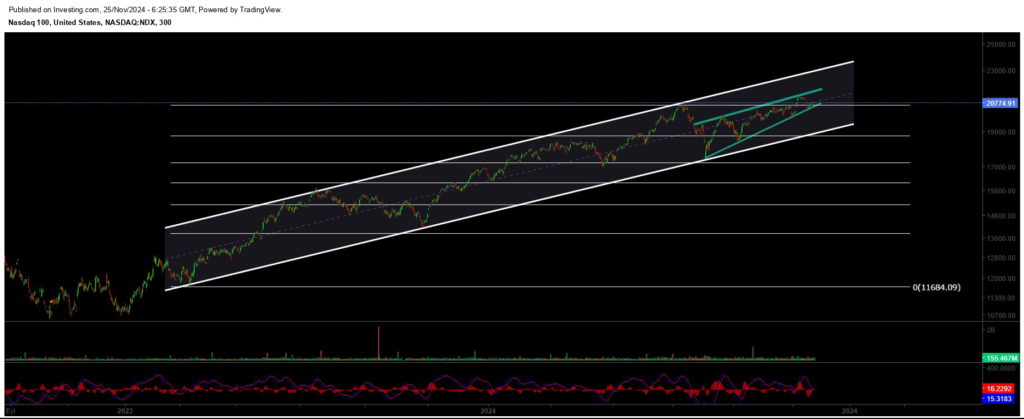

NASDAQ

The index, continuing its upward trend, is pricing above the 20,635 resistance level, maintaining its bullish momentum. In the event of potential pullbacks, two critical support levels stand out. Firstly, the 19,600 level serves as an important support zone in the short term. In case of a deeper pullback, the 18,400 level should be monitored as a strong buying area. Buyers are expected to step in at these levels.

Resistances: 20,635 / 22,400 / 23,000

Supports: 18,913 / 18,670 / 17,200

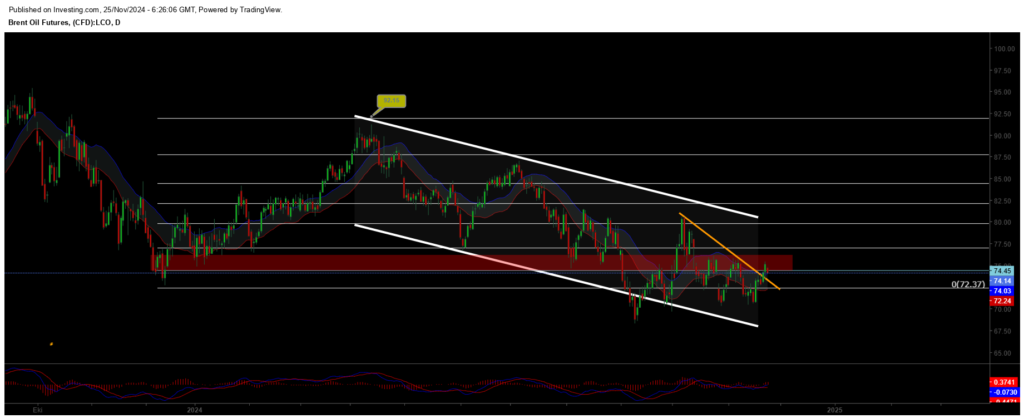

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

EURUSD

EUR/USD successfully broke through its ascending channel resistance and has been trading above both horizontal and channel resistance. It held above the 1.0983 resistance zone and reached our target of 1.114. However, facing selling pressure around 1.11, it lost this zone, creating a “deviation” and leading to a pullback. Now, the critical support level to watch for EUR/USD is 1.0983. Maintaining this level is crucial for stabilizing the price.

Resistances: 1.114 / 1.130 / 1.135

Supports: 1.098 / 1.088 / 1.080

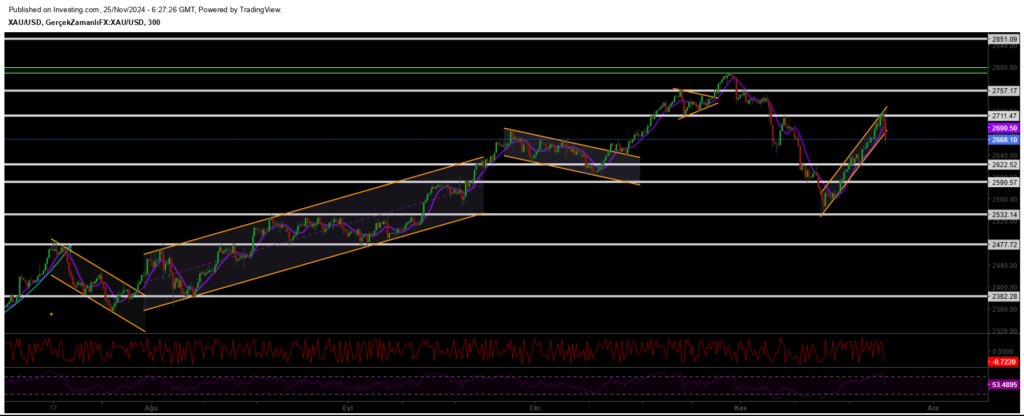

XAUUSD

Gold has successfully rebounded from the 2533 level, reaching the anticipated target. However, it faced strong selling pressure from the rising channel resistance and horizontal resistance zone. It is currently trading actively at the 2668 level. Further pullbacks seem likely in the near term. In this context, the 2652 level emerges as a key support to monitor closely.

Resistance Levels: 2711 / 2757 / 2800

Support Levels: 2622 / 2590 / 2530

Leave A Comment