💵 💴 💶25 Basis Point Cut, But Signals of Less Easing for 2025💴 💶

The U.S. Federal Reserve (Fed) is expected to lower interest rates by another 25 basis points on December 18, moving policy closer to a neutral stance from a restrictive zone. However, given persistently high inflation and President-elect Trump’s focus on boosting U.S. growth performance, the Fed is likely to signal a more cautious easing trajectory for 2025.

Bitcoin Surpasses $106,000 on “Strategic Reserve” Hopes

Bitcoin climbed above $106,000 as President-elect Donald Trump mentioned plans to establish a strategic bitcoin reserve in the U.S., similar to the strategic petroleum reserve. This announcement boosted investor appetite for Bitcoin. The largest and most well-known cryptocurrency reached $106,533, while Ether (ETH) rose by 1.5% to $3,965.

Oil Prices Begin the Week with a DropIn an environment where attention is focused on this week’s Federal Reserve meeting, oil prices have retreated from the highest levels seen in weeks. However, concerns over potential supply cuts, should the U.S. impose additional sanctions on key suppliers Russia and Iran, have limited the declines. Brent crude oil fell 25 cents, or 0.34%, this morning, to $74.24 per barrel.

Technical Overview

DXY

The U.S. Dollar Index (DXY) continues to trade within a descending wedge on the daily chart. Currently priced at 106.39, the index is holding above the 105.68 horizontal support level, suggesting the uptrend may persist for a while longer. If the trend continues, potential resistance levels are 107.34 and 110. A strong breakout above 107.34 could push the index towards 112.

Resistances: 108.00 / 110.00 / 115.76

Supports: 105.68 / 104.38 / 103.46

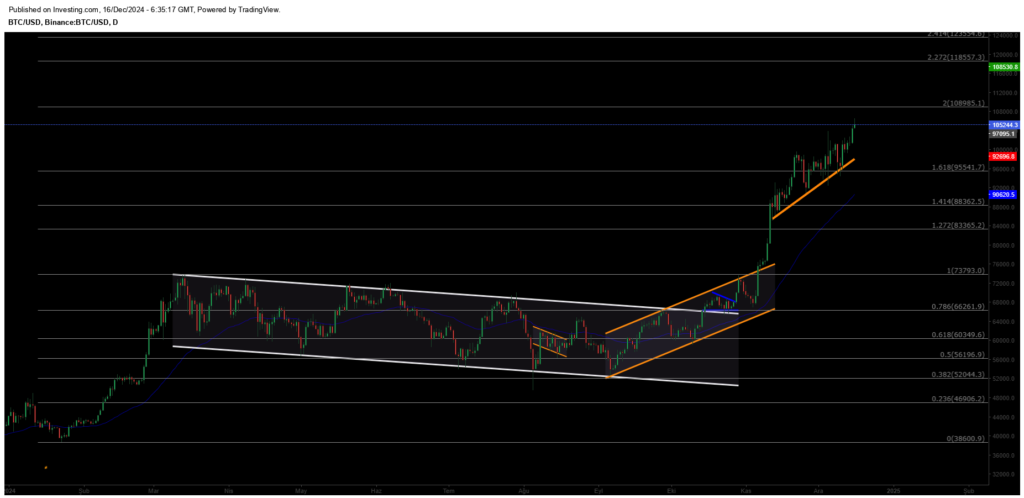

BTC/USD

Bitcoin’s uptrend has regained momentum, with the price currently at $97,691. Following recent declines, recovery efforts are ongoing. The key level to watch is $95,540. As long as this support level holds, Bitcoin may continue its climb towards $108,995. However, losing the $95,540 support could trigger a bearish trend, potentially pulling the price down to $88,362.

Resistances: 108,985 / 118,500 / 123,550

Supports: 95,500 / 88,362 / 83,365

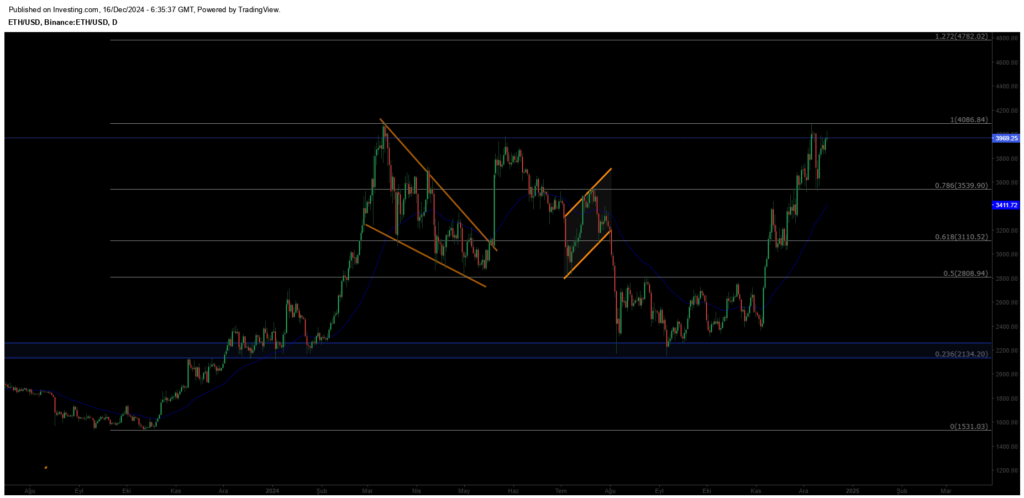

ETH/USD

Ethereum has reached its expected target of $4,086 before facing a sharp pullback. It is now trading at $3,673. The critical level to monitor is $3,539, which acts as horizontal support. As long as the price holds above this level, the outlook remains positive. However, if Ethereum closes below $3,539, the price could slide further to $3,110.

Resistances: 4,086 / 4,782 / 5,144

Supports: 3,539 / 3,110 / 2,808

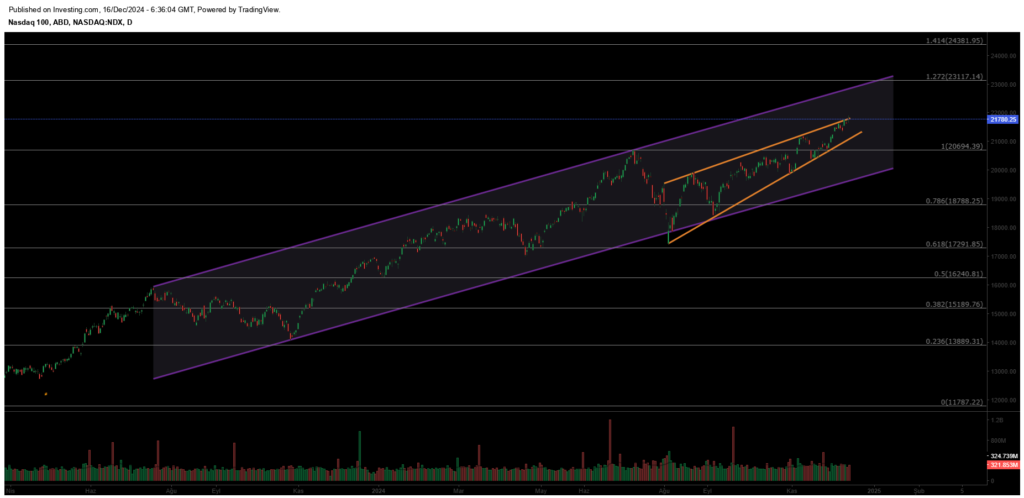

NASDAQ

The Nasdaq index continues its uptrend within a rising channel on the weekly chart. However, a wedge formation within the channel has rejected the price at the resistance level, with the index currently trading at 21,368. If the 21,700 level is surpassed and maintained, the index could break the main channel resistance and extend its rally to 22,500. On the downside, breaking below the critical 20,695 support may invite selling pressure, potentially pulling the index down to 20,000.

Resistances: 23,117 / 24,380 / 26,200

Supports: 20,694 / 18,788 / 17,291

BRENT

Brent crude has shown mid-term recovery, regaining its previously lost channel structure. Having surpassed the 76.98 resistance level, the price is likely to rise towards the 80.00–82.00 range if it maintains this level. Key support stands at 72.37, where buyers are expected to step in to sustain the trend.

Resistances: 76.15 / 85.84 / 95.53

Supports: 70.17 / 69.00 / 67.80

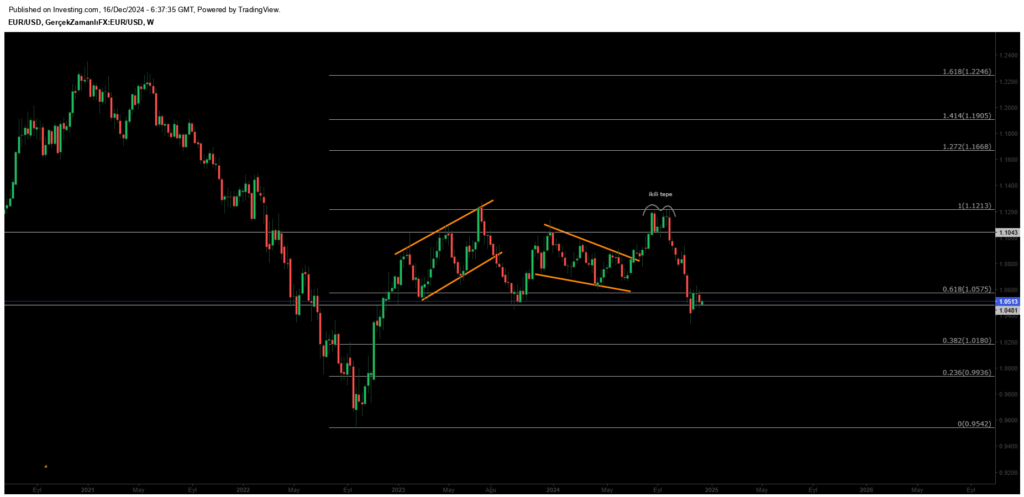

EURUSD

The Euro formed a double top at 1.11 and entered a downtrend. Losing the 1.10 support led to a pullback to the lower channel boundary at 1.07. After breaking the rising support level, the Euro slid to 1.046. At this critical support level, buyers are likely to re-enter the market. However, if the support is broken, the Euro may face deeper declines, potentially reaching 1.099. Price action at these levels will be pivotal in determining the next directional move.

Resistances: 1.0575 / 1.1043 / 1.1213

Supports: 1.0180 / 0.9936 / 0.9542

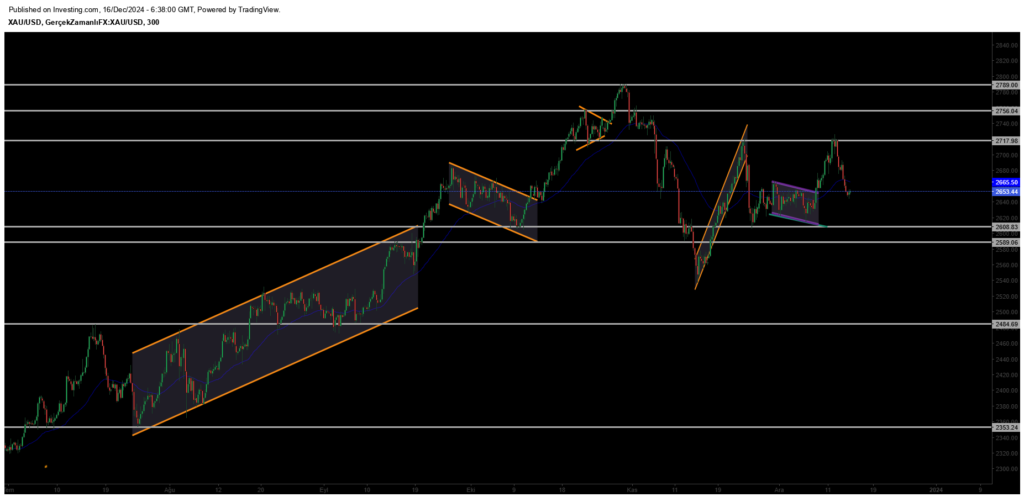

XAUUSD

Gold recovered from the 2533 level, reaching its expected target, but encountered strong selling pressure at the rising channel resistance and horizontal resistance zones. Currently trading at 2668, further pullbacks are likely. The 2652 level serves as the key support to watch.

Resistance Levels: 2708 / 2757 / 2790

Support Levels: 2622 / 2590 / 2530

Leave A Comment