💵 💴 💶Trump Administration Plans to Allow Banks to Trade Cryptocurrencies💴 💶

Trump’s second presidential term is kicking off with significant changes that enable banks to enter the cryptocurrency trading space. Circle CEO Jeremy Allaire stated that these new policies will make it easier for banks to provide crypto trading services to their customers. The Trump administration plans to revoke the SEC’s SAB 121 regulation, which previously made it difficult for banks and financial institutions to include crypto assets in their balance sheets. Allaire expressed optimism, noting that the removal of this regulation would give the sector a positive boost.

GLOBAL MARKETS

Donald Trump’s second term as U.S. president is drawing close attention to his trade policies, particularly regarding tariffs. With U.S. markets closed yesterday due to a public holiday, the impact of Trump’s return to the White House is being felt in today’s Asian trading sessions. Although Trump briefly mentioned tariffs during his inaugural speech, investors speculated that tariff implementations might be delayed. However, Trump later announced plans to impose a 25% tariff on Mexico and Canada starting February 1.

Elon Musk’s DOGE Department Faces Lawsuit on Its First DayAlthough not officially sanctioned by Congress, the Department of Government Efficiency (DOGE) is set to serve as an advisory body aimed at reducing government expenditures. However, according to The Washington Post, the institution may face legal action for violating federal transparency laws. Prosecutors are reportedly preparing to file a lawsuit as the department begins operations today.

Technical Overview

DXY

Bitcoin initiated an uptrend with Trump officially taking office, reaching as high as $109,000. Setting a new all-time high, BTC is expected to extend its bullish trend to $123,194 with daily closes above the $108,286 region.

Resistance: 118,500 / 123,550 / 131,029

Support: 108,985 / 92,000 / 88,362

BTC/USD

Bitcoin initiated an upward trend following Trump’s official return to office, reaching as high as $109,000. However, it failed to sustain above the 108,286 zone and faced selling pressure. If Bitcoin can break above the 108,186 resistance level, it could climb further to 123,194.

Resistance: 108,985 / 118,500 / 123,550

Support: 92,000 / 88,362 / 80,598

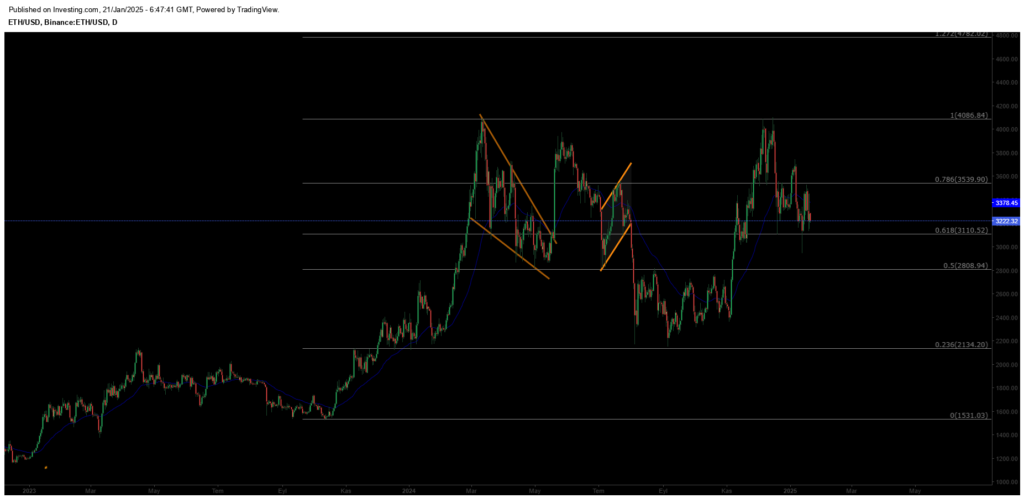

ETH/USD

Ethereum has seen a long-awaited rise, reaching $3,400. The next critical resistance zone to monitor is $3,539. A strong breakout above this level could further sustain Ethereum’s uptrend.

Resistances: 3,539 / 4,086 / 4,782

Supports: 3,110 / 2,808 / 2,134

NASDAQ

The index’s uptrend continues to strengthen within the ascending channel structure on weekly charts. Short-term declines could lead to resistance breakouts, potentially driving the index back to 22,143 in the near term. The key support zone to watch for pullbacks is 19,643.

Resistances: 22,143 / 25,320 / 26,979

Supports: 19,643 / 17,681 / 16,303

BRENT

Brent Crude is experiencing medium-term recoveries and has regained its previously lost channel structure, continuing its uptrend. Having surpassed the 76.98 resistance level, prices are expected to climb toward the 85.00 range if sustained above this level. Key support during pullbacks is 72.37.

Resistances: 85.84 / 95.53 / 102.43

Supports: 80.00 / 76.15 / 70.17

EURUSD

The Euro formed a double top at the 1.11 level and entered a downtrend. After breaking below the 1.10 support, it has retreated to the lower band of its channel at 1.0367. Buyers may step in at this critical support, but a break lower could see further declines to 1.018.

Resistance Levels: 1.0575 / 1.1043 / 1.1213

Support Levels: 1.0180 / 0.9936 / 0.9542

XAUUSD

Gold rebounded from the 2,610 support level, reclaiming its upward trend. It has broken past the 2,666 resistance with strong volume. On potential pullbacks, the 2,665 support zone should be monitored closely.

Resistance: 2,756 / 2,790 / 2,800

Support: 2,717 / 2,666 / 2,589

Leave A Comment