💵 💴 💶White House Crypto Statement: Bitcoin Reserve on the Agenda💴 💶

David Sacks, the U.S. official responsible for crypto and artificial intelligence policies, held a press conference alongside members of the Senate and House of Representatives. Evaluating the U.S. approach to digital assets, Sacks stated that the idea of creating a Bitcoin reserve is still on the table and that the administration will prioritize this issue.

Oil Prices and Geopolitical Developments

Oil prices have been fluctuating due to tariff tensions between Washington and Beijing, as well as former U.S. President Donald Trump’s decision to reinstate his “maximum pressure” campaign against Iran. According to a U.S. official, the Trump administration took this step to bring Iran’s oil exports down to zero. The “maximum pressure” policy on Iran is currently helping to offset the negative impact of the tariff crisis between Beijing and Washington on oil prices. While China’s retaliation initially pushed oil prices to their lower trading range, prices rebounded due to the renewed “maximum pressure” campaign against Iran.

U.S.-China Tensions Pressuring Bitcoin, but Experts Remain Optimistic for Record HighsMarkets had previously rallied on news that the U.S. would delay tariffs on Mexico and Canada for a month. Additionally, former President Donald Trump signed an executive order aimed at establishing the first sovereign wealth fund of its kind. White House Crypto Director David Sacks is set to hold another press conference to share further details on U.S. digital asset policy.

Technical Overview

DXY

Bitcoin initiated an uptrend with Trump officially taking office, reaching as high as $109,000. Setting a new all-time high, BTC is expected to extend its bullish trend to $123,194 with daily closes above the $108,286 region.

Resistance: 118,500 / 123,550 / 131,029

Support: 108,985 / 92,000 / 88,362

BTC/USD

Bitcoin experienced a sharp pullback after the announcement of U.S. tariffs. It dropped to the $90,000 support level, where buyers stepped in. If this level is lost, selling pressure on BTC is expected to increase.

Resistance Levels: 108,985 / 118,500 / 120,500

Support Levels: 96,378 / 87,109 / 80,598

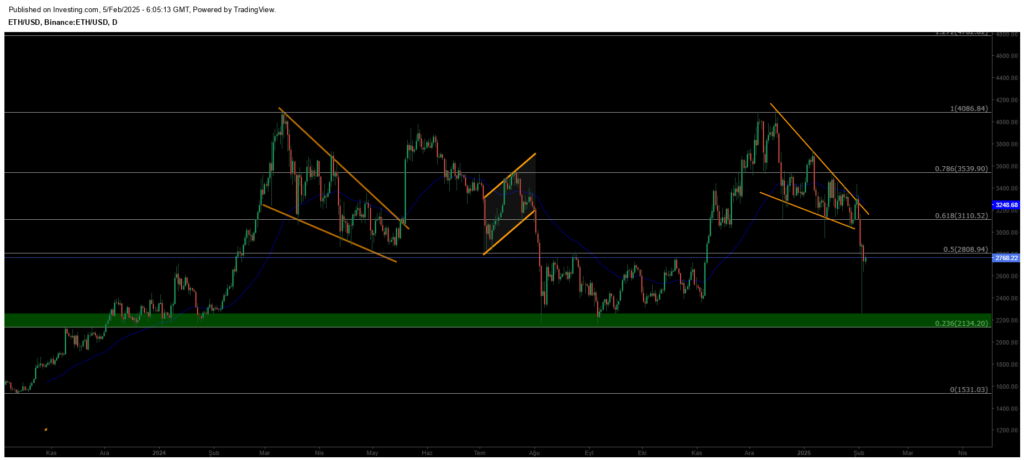

ETH/USD

Ethereum saw the expected sharp decline, retreating to the $2,200 support zone. Losing this level will extend selling pressure. However, if ETH manages to maintain a price above $2,800, it could regain upward momentum.

Resistance levels: 2,808 / 3,110 / 3,539

Support levels: 2,134 / 1,530 / 1,300

NASDAQ

The NAS100 index has experienced a sharp pullback in response to the launch of China’s AI initiative, reflecting significant pressure on U.S. indices. The major support level to watch on the index is $19,643. Losing this level could intensify the selling pressure on the index.

Resistance Levels: 22,143 / 25,320 / 26,979

Support Levels: 19,643 / 17,681 / 16,303

BRENT

Brent oil is in recovery mode, reclaiming its previously lost channel. Having broken above the 76.98 resistance, the price is likely to target the 85.00 range. The critical support level is 72.37, which should hold to maintain the uptrend.

Resistance Levels: 80.00 / 85.84 / 95.53

Support Levels: 76.15 / 70.17/ 69.99

EURUSD

The Euro formed a double top at the 1.11 level and entered a downtrend. After breaking below the 1.10 support, it has retreated to the lower band of its channel at 1.0367. Buyers may step in at this critical support, but a break lower could see further declines to 1.018.

Resistance Levels: 1.0575 / 1.1043 / 1.1213

Support Levels: 1.0180 / 0.9936 / 0.9542

XAUUSD

Gold, after initiating an upward momentum, has refreshed its all-time high (ATH), breaking through the 2827 resistance level and continuing to trade at 2857. The next resistance level to watch is 2880..

Resistance Levels: 2880 / 2900 / 2920

Support Levels: 2827 / 2787 / 2764

Leave A Comment